When a patient gets a prescription for a generic specialty drug, it doesn’t mean they walk into a local pharmacy and pick it up like a bottle of ibuprofen. Even though the drug is no longer brand-name, the process is still complex, tightly controlled, and heavily reliant on specialty pharmacies. Providers-doctors, nurse practitioners, and clinics-play a central role in making sure these medications reach patients correctly. But why does this matter? Because the difference between a brand and a generic specialty drug isn’t about cost alone. It’s about how the drug is handled, monitored, and delivered.

What Makes a Drug a ‘Specialty’ Drug?

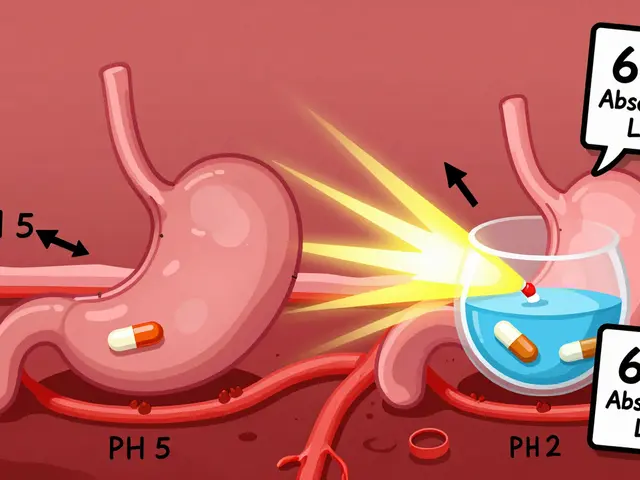

A specialty drug isn’t defined by its price tag alone. It’s defined by its complexity. These are medications that often require special handling, like refrigeration, or special administration, like IV infusions or injections. Many are used to treat chronic, serious conditions: rheumatoid arthritis, multiple sclerosis, hepatitis C, cancer, and rare genetic disorders. Even when these drugs become generic, they don’t lose their specialty status. That’s because the drug’s molecular structure, delivery method, or safety risks still demand expert oversight. The FDA doesn’t approve traditional generics for most biologic drugs-those made from living cells-because they’re too complex to copy exactly. Instead, they approve biosimilars, which are highly similar but not identical versions. These still count as specialty drugs. Whether it’s a brand-name biologic, a biosimilar, or a small-molecule generic like methotrexate in a complex formulation, if it requires special handling or monitoring, it’s handled by a specialty pharmacy.Why Can’t Retail Pharmacies Dispense Generic Specialty Drugs?

You might think: if it’s generic, why can’t Walgreens or CVS fill it? The answer is simple: manufacturers control distribution. Many drugmakers require that even generic or biosimilar versions of their drugs be dispensed only through specialty pharmacies. This isn’t about profit-it’s about safety and compliance. These drugs often come with REMS programs (Risk Evaluation and Mitigation Strategies) mandated by the FDA. These programs track patient outcomes, enforce mandatory lab tests, and require provider and pharmacist education. Retail pharmacies don’t have the infrastructure to manage these requirements. They don’t have nurses on staff to call patients weekly. They don’t track temperature logs for shipments. They don’t coordinate with insurance for prior authorizations that can take days. A 2023 study showed that specialty pharmacies handle an average of 12-15 data points per patient. Retail pharmacies handle 5-7. That gap isn’t just paperwork-it’s patient safety.The Provider’s Role: More Than Just Writing a Prescription

Providers don’t just write a script and move on. They’re gatekeepers to the entire specialty pharmacy system. When a patient needs a generic specialty drug, the provider must:- Confirm the diagnosis matches the drug’s approved use

- Choose the right version-brand, biosimilar, or generic-based on clinical guidelines and payer rules

- Submit the prescription to a specialty pharmacy that’s contracted with the patient’s insurance

- Complete any required documentation for REMS programs

- Coordinate with the pharmacy to ensure the patient gets education and support

How Specialty Pharmacies Handle Generic Versions

The workflow for dispensing a generic specialty drug is nearly identical to that of a branded one:- Prescription intake - The pharmacy receives the e-prescription and checks for completeness.

- Prior authorization - The pharmacy contacts the insurer to get approval. This step can take 3-7 days, even for generics.

- Financial assistance - Many patients need help with copays. Specialty pharmacies have teams that apply for grants and manufacturer assistance programs.

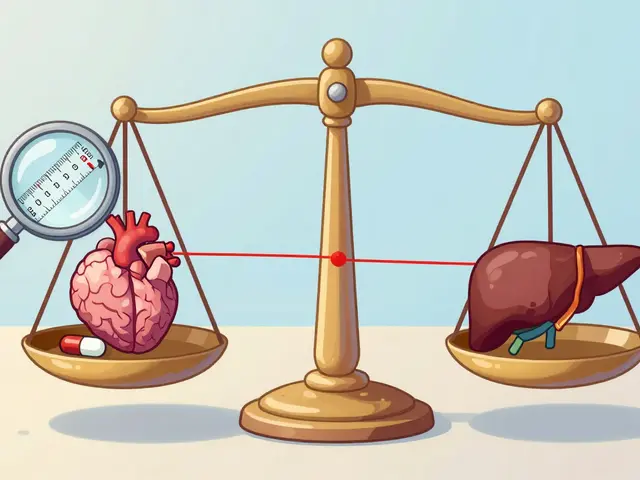

- Clinical review - A specialty pharmacist reviews the patient’s history for interactions, kidney or liver function, and other risks.

- Patient education - Nurses or care coordinators call the patient to explain how to use the drug, what side effects to watch for, and when to call for help.

- Dispensing and delivery - The drug is packed in temperature-controlled packaging and shipped directly to the patient’s home.

- Follow-up - The pharmacy calls back in 7-14 days to check on tolerance, side effects, and adherence.

Patients Notice the Difference

Patient feedback tells a clear story. On Reddit, users report mixed feelings. Some say: “I got my generic version of Xeljanz through the same specialty pharmacy. The nurse still knows my name and remembers my last lab results.” Others complain: “I went from a $15 copay at Walgreens to $75 with a two-week wait. What am I paying for?” But here’s what the data shows: patients who stay with the same specialty pharmacy during a switch from brand to generic report 68% higher satisfaction. Why? Because continuity of care matters. The same nurse who taught you how to inject your drug last year is still there when you switch to the cheaper version. That relationship saves lives. Trustpilot data from May 2024 shows specialty pharmacies average 3.8 out of 5 stars. But when it comes to clinical support, the rating jumps to 4.2. Delivery speed? Only 3.1. That tells you what patients value most: expertise, not speed.

The Bigger Picture: Why This Model Isn’t Going Away

The U.S. specialty pharmacy market hit $215 billion in 2023. That’s 34.6% of all pharmaceutical spending, even though specialty drugs make up only 3% of prescriptions. And it’s growing fast-12.3% per year, compared to 4.7% for retail. Biosimilars are the next wave. By 2026, specialty pharmacies expect a 40% increase in biosimilar volume. Medicare is now required to cover all FDA-approved biosimilars. That means more generic specialty drugs will flow through these channels. Health systems are trying to bring this work in-house. In 2024, 63% of hospitals said they planned to build their own specialty pharmacy operations. But that’s not easy. It requires hiring trained pharmacists, building secure cold-chain logistics, and integrating with insurance systems. Most can’t do it well-or afford to. As John Prince of Drug Channels Institute put it: “The distinction between brand and generic becomes almost irrelevant. The service model determines the channel.”What Providers Need to Know Moving Forward

If you’re a provider managing patients on generic specialty drugs, here’s what you need to do:- Know which drugs require specialty pharmacy distribution-even if they’re generic.

- Build relationships with a few trusted specialty pharmacies. Don’t let insurance dictate the choice.

- Use Real-Time Prescription Benefit (RTPB) tools to check coverage before prescribing. This cuts prior auth delays by 3+ days.

- Explain the process to patients upfront. Don’t wait for them to complain about delays or copays.

- Track outcomes. If a patient switches to a biosimilar, monitor for adverse events. Some insurers still push brand-name drugs even when generics are available.

Can a retail pharmacy dispense a generic specialty drug?

No-not if the drug is under a manufacturer’s distribution mandate. Even if it’s a generic or biosimilar, if the drug requires special handling, storage, or monitoring, it must be dispensed through a specialty pharmacy. This is set by the drugmaker, not the pharmacy type.

Why is the copay higher for generic specialty drugs through specialty pharmacies?

The higher copay often reflects the cost of services, not the drug itself. Specialty pharmacies include nursing support, prior authorization help, financial aid applications, and home delivery-all bundled into the price. Retail pharmacies don’t offer these services, so their copays are lower, but patients get less support.

Are biosimilars the same as generic drugs?

No. Biosimilars are highly similar to biologic drugs but not identical, because biologics are made from living cells and can’t be copied exactly. Traditional generics are exact copies of small-molecule drugs. Biosimilars still count as specialty drugs and require the same handling and monitoring as their brand-name counterparts.

Do I need to switch specialty pharmacies when my drug goes generic?

No, and you shouldn’t. Staying with the same specialty pharmacy ensures continuity of care. Your care team already knows your history, side effects, and treatment plan. Switching can lead to delays, miscommunication, and lost data. Most patients report better outcomes when they stay with the same pharmacy.

How long does it take to get a generic specialty drug?

On average, it takes 7.2 days from prescription receipt to delivery. This includes time for insurance approval, financial assistance applications, and clinical review. Oncology and hepatitis C drugs often take longer-up to 9 days. Retail prescriptions are filled in about 1.2 days.

What’s the role of REMS programs in dispensing generic specialty drugs?

REMS programs are FDA-mandated safety plans that track patient risks. Even for generic or biosimilar drugs, if the original brand had a REMS, the generic version must follow the same rules. This means mandatory lab tests, provider training, and patient education-all handled by specialty pharmacies.

Is there a trend toward bringing specialty pharmacy services in-house?

Yes. About 63% of health systems plan to build their own specialty pharmacy operations by 2026. But most still rely on external specialty pharmacies because of the high cost and complexity of building the required infrastructure-cold storage, trained staff, and integrated IT systems.

12 Comments

Why do we even need all this drama for a generic? I get it’s fancy medicine, but why can’t I just get it like my blood pressure pills? It’s 2024, not 1994.

Let me get this straight-Americans pay $75 for a generic because some pharmacy has a nurse who calls you? Meanwhile, in China, they ship these drugs by drone with a QR code that tells you how to inject it. We’re being scammed.

It’s not about the drug-it’s about the ritual. The cold pack. The nurse who remembers your dog’s name. The way the pharmacist pauses before saying, ‘This one’s different.’ That’s not logistics-that’s healing with a spreadsheet. We’ve turned care into a symphony, and retail pharmacies? They’re playing tin cans.

REMS compliance, clinical review, adherence monitoring-these aren’t perks, they’re clinical necessities. For high-risk biologics and complex generics, the risk stratification alone justifies the model. Skipping it is malpractice in disguise.

So… we’re paying extra for someone to text us ‘hey, did you take your methotrexate?’ That’s cute. But if my insurance covers a $15 pill, why am I paying $75 for a phone call? Someone’s making bank.

They say ‘generic doesn’t mean simple’-but what they really mean is ‘we’ve built a $200 billion empire on fear, paperwork, and the illusion of expertise.’ The drug is the same. The packaging is the same. The only thing different? The middlemen who turned compassion into a subscription service.

You know, in India, we have these little clinics where a pharmacist gives you the pill, tells you when to take it, and asks if you ate breakfast. No cold chain. No nurse calls. No 7-day wait. And people live. We don’t need a whole system just because we can build one. Sometimes, simple is smarter. Complexity is a luxury we can’t afford everywhere.

I’ve been on a biosimilar for two years. The specialty pharmacy called me every week. When I had nausea, they mailed me ginger tea. When my lab was off, they rescheduled my infusion. I didn’t just get a drug-I got a safety net. That’s worth more than a $15 copay.

Let’s be real-this whole system exists because American pharma wants to keep profits high. Generic? Sure. But make it ‘special.’ Make it ‘complex.’ Make it take weeks. Then charge extra. We’re not saving lives-we’re gaming the system.

My mom switched from brand to generic through the same pharmacy. The same nurse who taught her to inject it five years ago? Still called her every Tuesday. That’s not a business model-that’s family.

Y’all are overthinking this. It’s not about the drug. It’s about the person who remembers your kid’s name, sends you memes when you’re having a bad day, and makes sure you don’t miss a dose. That’s not a pharmacy-that’s a lifeline. And yes, it costs more. But you can’t put a price on someone caring.

My sister’s on a generic specialty drug-same drug, same dose, same manufacturer as the brand. But now she’s got a care coordinator, a 24/7 hotline, and a temperature-controlled box that texts her when it’s delivered. She says it feels like someone’s watching over her. That’s not a cost-it’s peace of mind. And honestly? That’s worth the wait.